by Scott Martin | Apr 21, 2024 | Weekly Newsletter 7pm Sunday

Market Summary

The Bull Market Report

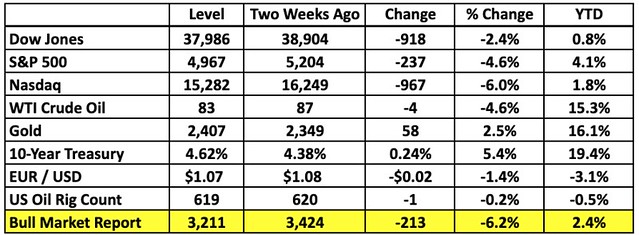

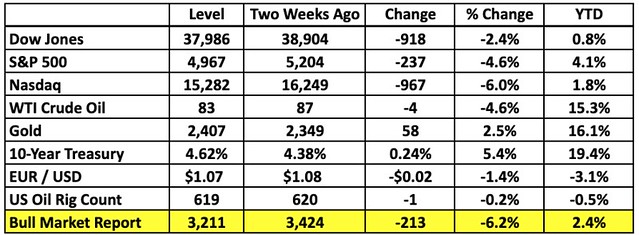

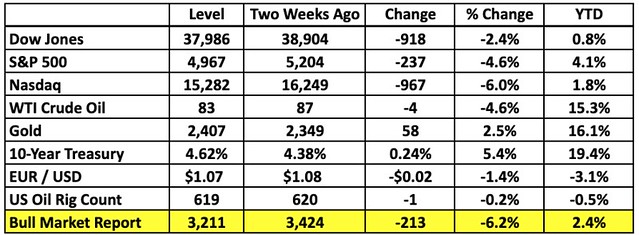

While some investors are convinced that September and October are the cruelest months, this year we're seeing April play out as a stormy season. Our stocks have stepped a collective 6% back since the month started, giving back nearly all their once-substantial YTD gains. Likewise, the Nasdaq and the Dow Industrials have also seen their 1Q rally evaporate, leaving both indices along with us on the brink of breakeven. Only the S&P 500, as middle-of-the-road as it gets in the modern market, is showing the bears any resistance whatsoever, and it's still down 5% so far this month.

People can blame the bond market for this, but in our view the situation is both more complicated and so simple that it needs little explanation at all. The last time stocks shuddered like this, nobody knew whether the Fed was finally done raising short-term interest rates, which ensured that there was still enough anxiety circulating to keep investors off balance. We had a pretty good sense then that the Fed's "pause" would continue for the foreseeable future, but nobody had the confidence to say for sure. As a result, money flooded out of the Treasury market into higher-yielding cash, leaving bond prices reeling and pushing yields up to 5% in the process.

A similar dynamic has played out this time around. The mood around the Fed has gotten significantly softer, with investors who had once hoped for nothing better than an extended end to rate hikes starting to bet more confidently on active rate cuts in the coming year. However, even that improved attitude is vulnerable to second guessing and frustration when the economic numbers flow the wrong way. As long as inflation remains stubbornly persistent, the Fed's calculus around rate cuts in the near term will remain difficult, and the hope that dominated the market early in the year gives way again to doubt.

That's the complex narrative. But when you look at the way stocks and bonds have moved in the last six months, you'll see a much simpler pattern emerge. Bond yields got so high in November that they started to strain the statistical limits, triggering an inevitable bounce when conditions finally reached an unsustainable level. When that happened, yields dropped and stocks rebounded. There wasn't any deep narrative going on here. It was just statistics. And then, around the new year, yields had swung all the way from testing the statistical ceiling to crawling on the floor, pushing markets in the opposite direction in response.

Again, just statistics. Money followed its own cyclical tide and human beings scrambled to tell the tale. The Fed didn't get in the way. A few weeks ago, markets were in roughly the same position as they were back in November. The cycle played out again. The earnings reports we'll review in the next few weeks may accelerate the ongoing correction; or give investors a strong enough reason to defy statistics and start buying again. For now, however, we're resigned to see stocks drift a little while before regaining their equilibrium. All part of life on Wall Street.

At moments like this, we look for pockets of relative strength and weakness to make sure we're positioned the right way to exploit the market's next moves. The fact that the losses are relatively evenly distributed tells us that this is not a problem for the economy or any particular sector. Our Healthcare recommendations are down roughly as much as our High Yield stocks this month, and the REITs and Stocks For Success have also experienced roughly the same level of pain in the last few weeks. When such a large slice of the market drops at the same speed and correlations across otherwise unrelated industries converge, the normal pattern of distributed strength and weakness disintegrates. There's no shelter, in other words. Defense and offense, established companies and speculative ones are all moving together.

That's the kind of move that tends to reverse itself in the pattern we've watched since November. In the meantime, we appreciate our Energy portfolio more than ever, as well as our allocation to SPDR Gold Shares (GLD). Gold is a hedge when everything else is suffering. That's why we're happy to be in gold right now.

There's always a bull market here at The Bull Market Report. With earnings season just underway, The Big Picture lays out where the growth is across the market and where we can anticipate it. The Bull Market High Yield Investor is all about making sure the yields we've gotten in the past will continue, which is important when the Fed keeps rates higher than a lot of investors think they can stand. And as always, we're talking about a few of our favorite stocks, including a few that have the power to change the market's mood when they report over the next few days. Don't forget: if you'd like different coverage or more detail on any topic, you know how to reach us. (Todd@BullMarket.com 970.544.1707).

Key Market Indicators

-----------------------------------------------------------------------------

The Big Picture: Where The Growth Is

-----------------------------------------------------------------------------

BMR Companies and Commentary

Axcelis Technologies (ACLS: $95, down 9% last week)

High Technology Portfolio

Axcelis Technologies designs and manufactures critical equipment for the $550 billion global semiconductor industry. It recently released its fourth-quarter results, reporting $310 million in revenue, up 17% YoY, compared to $270 million a year ago. It posted a profit of $70 million, or $2.15 per share, against $65 million, or $1.99, with a beat on consensus estimates on the top and bottom lines.

As the global semiconductor boom accelerates, Axcelis continues to see strong demand for its Purion Power Series product family, hitting $1.2 billion in order backlogs to end the year 2024. This can largely be attributed to the semiconductor nationalism, aimed at reducing dependence on Taiwan and minimizing the supply chain risks that come with the same. In addition to this, Axcelis is currently riding on the coattails of many other tailwinds, ranging from the electrification of the automotive industry to the global rollout of 5G, IoT, IIoT, and AI, among others. The company generates 98% of its revenue from the ion implantation market, where it maintains a strong portfolio of products, alongside substantial blockades leaving it with very few worthy competitors.

The stock, alongside the company’s performance, cooled off substantially over the past year, and much of this can be attributed to the rationalization of capital expenditure in the industry. Apart from this, China, where Axcelis generates 46% of its revenues, was been hit with a prolonged slowdown. However, now that the country is starting to turn around once again, we expect robust demand going forward.

After surging 140% in the first half of 2023, the stock has shed more than half its value from its all-time high of $201 last summer, currently down 24% year-to-date. This creates an interesting situation: a growth stock with a compelling valuation, trading at under 3 times sales and 12 times earnings, especially as it begins returning capital to investors with $15 million in buybacks during the quarter. With $510 million in cash, just $45 million in debt, and $160 million in cash flow, the company is poised for strong future growth in this industry that is roaring on all engines. The Target is $200 with a Sell Price of $105, both of which should be adjusted today. The stock is sitting now where it was a little over a year ago. In 2021, the stock was at $30. So let’s look at revenues and earnings.

| Year |

Revenue |

Earnings |

| 2023 |

$1.15 billion |

$250 million |

| 2022 |

$920 million |

$180 million |

| 2021 |

$660 million |

$100 million |

Note that the company is still tiny compared with the big boys in the industry, with a market cap of just $3 billion. The company might just be on the buyout list of many companies in the business.

We are moving the Target to $150 and the Sell Price to $75.

-----------------------------------------------------------------------------

Bill Holdings (BILL: $60, down 3%)

High Technology Portfolio

Financial management platform for small and medium-sized businesses, Bill posted its second-quarter results recently, reporting $320 million in revenue, up 20% YoY, compared to $260 million a year ago. It posted a profit of $70 million, or $0.63 per share, against $50 million, or $0.42, with a beat on consensus figures on the top and bottom lines, coupled with robust guidance for the third quarter and full year.

The company generates the bulk of its revenues from subscriptions and transaction fees, at $275 million, up 19% YoY, followed by float revenue, which is interest earned on client deposits, at $43 million. The latter number was a significant increase in recent years owing to higher prevailing interest rates. During the quarter, the company processed $75 billion in payments, across 26 million transactions, up 11% and 23%, respectively. The platform now hosts 470,000 small and medium-sized businesses located all across the world, up 19% YoY, alongside 5.8 million network members, 7,000 accounting firms, and 7 out of the 10 largest financial institutions, resulting in a strong barrier to its competition.

The company saw a marked slowdown in its growth rate, from 65% YoY in 2023 to just 20% during this particular quarter. This is owing to its significant macro exposure, and the prevailing broader slowdown, coupled with the company hitting a saturation point in certain regards. Its next stage of growth will come internationally, where it has an addressable market of over 330 million businesses.

Despite an 82% pullback in the stock from its all-time high in 2021, it still features a fairly expensive valuation of 5 times sales and 21 times earnings. During the quarter, the company returned $200 million to investors in stock buybacks, made possible by its $2.6 billion in cash reserves, $1.9 billion in debt, and $250 million in cash flow. Our Target is $85 and our Sell Price is $50. The company produced strong growth in revenues, having done $240 million in fiscal 2021, $640 million in 2022, and $1.05 billion in 2023. It appears that revenue for the fiscal year that ends June 2024, will total about $1.2 billion, quite a slowdown, just 16-18% growth when we have been used to 50%+ growth.

Bill Holdings has a $6 billion market cap, quite a comedown from the $36 billion it hit in 2021. Do we want to hang with the company now after this comedown? That’s a good question and one that you have to ask yourself as well. We like companies that are growing 30% a year or more, but perhaps we are entering a different dynamic lately and should be pleased with 15-20% growth. We’re going to stick with the company for a little bit longer but watch it closely. If the stock moves to the $55 level, our new Sell Price, we are moving on.

-----------------------------------------------------------------------------

PayPal (PYPL: $62, down 4%)

Financial Portfolio

Global payments giant PayPal released its fourth quarter results recently, reporting $8.0 billion in revenues, up 9% YoY, compared to $7.4 billion a year ago. It posted a profit of $1.6 billion, or $1.48 per share, against $1.4 billion, or $1.24, beating consensus figures on the top and bottom lines. The company, however, disappointed some on Wall Street, with its guidance for the coming year, at 6.5% revenue growth, making us think long and hard about the future of this investment. For the year, the company did $30 billion in revenue, up 8%, up 75%(!), with $4.2 billion in profits. The is no small company, clocking in at $65 billion in market cap.

The numbers are certainly big. During the quarter, the company’s payment volumes hit a record $410 billion, up 15% YoY, and $1.5 trillion for the full year, up 13% YoY. This was driven by a 14% YoY rise in total transactions per account, at 59, helping offset a slight decline in the total active accounts on the platform at 426 million, down 2%. This was largely the result of the company ending its extensive promotions involving bonuses and cashbacks.

Two years ago, PayPal was forced to manually close over 4 million accounts in response to massive promo fraud and abuse. It marked a shift in the company’s marketing strategy, and the repercussions of this are being felt to this day. It is now focused on the quality of accounts, rather than merely focusing on fresh new accounts opened, and it seems to be working well given the positive metrics that have resulted.

PayPal introduced several new services and initiatives in recent months, the most promising of which is its PYUSD stablecoin, designed to make international payments a lot smoother. It allows users to transfer US dollars to over 160 countries, without incurring any transaction fees, marking the company’s biggest foray into cryptocurrencies, in the $150 billion stable currencies market.

Following an 80% pullback since its all-time high in 2021, the stock trades at an enticing valuation of just 2.3 times sales and 12 times earnings. With a string of new products, services, and initiatives around the corner, extensive restructuring, and $5 billion in buybacks, we expect strong value creation in the months ahead. It ended the quarter with $14 billion in cash, $12 billion in debt, and $5 billion in cash flow. Our Target is $75 and our Sell Price is $48, hereby raised to $54. We’ve been with this company a long time, having added it at $31 in 2016. We’re looking at a 100% return which is fair, but the return was a lot better by 2021, three years ago, when it hit $310. Will it ever return to its glory days? Tough question. At this level and valuation, we have a company that is growing (revenues of $21 billion in 2021, $30 billion in 2023), with strong profits each year. We like this company and would suggest you stick with it and add to it as it moves higher (or lower – either way a winning strategy). The company is a leader, is strong financially, and will come out on top as we move into the 2nd half of the roaring 2020s.

-----------------------------------------------------------------------------

Shopify (SHOP: $70, flat)

High Technology Portfolio

eCommerce platform Shopify had a phenomenal fourth quarter to cap off an impressive year, posting $2.1 billion in revenue, up 24% YoY, compared to $1.7 billion a year ago. The company posted a profit of $440 million, or $0.34 per share, against $93 million, or $0.07, beating consensus estimates on the top and bottom lines, yet investors were dismayed with the light guidance provided for the new year.

The company’s merchant solutions segment led the way with $1.6 billion in revenue, up 21% YoY, followed by subscription solutions at $525 million, up 31% YoY. This was driven by steady growth in gross merchandise volumes and payments, at $75 billion and $45 billion, up 23% and 32% YoY, respectively, as Shopify penetrates deeper into the commerce value chain while being aided by a resilient US economy.

Shopify unveiled many new products and services during the quarter, starting with Shopify Magic, its suite of new AI tools to help run stores more efficiently. This was followed by Sidekick, its AI-enabled commerce assistant, and its new ChatGPT-powered shopping assistant for consumers, all aimed at unlocking value for merchants on the platform, and helping them go toe-to-toe against larger retailers.

The platform now powers 11% of all e-commerce sales in the US, an amazing number when you concentrate on it, and has endless potential for further growth, both in the US and internationally. What began as a solution for small businesses to set up online storefronts with ease turned into the platform of choice for large B2B and consumer brands, including the likes of AllBirds, Mattel, and Carrier among others.

Let’s take a moment to discuss what makes Shopify such a great company:

Shopify's success stems from a combination of factors for both e-commerce businesses and investors. Here's a breakdown of its strengths:

Ease of Use and Scalability

Simple Interface: Shopify boasts a user-friendly platform that allows entrepreneurs with minimal technical expertise to set up and manage their online stores.

Scalability: As businesses grow, Shopify scales with them. They can adjust their plans and add features seamlessly to accommodate increasing needs.

Wide Range of Features and Integrations

Built-in Features: Shopify offers a comprehensive suite of features for managing products, inventory, payments, shipping, marketing, and analytics.

App Store: The Shopify App Store provides access to thousands of additional apps and integrations, allowing businesses to customize their stores and extend functionality.

Strong Ecommerce Ecosystem

App Developers: A thriving app developer community constantly creates new extensions and tools for the Shopify platform.

Payment Gateways: Integrates with various popular payment gateways, offering flexibility for customers.

Support Resources: Provides extensive documentation, tutorials, and a supportive community for troubleshooting and learning.

Focus on Merchants

Affordable Pricing: Offers tiered pricing plans to cater to businesses of all sizes, making it an attractive option for startups and growing companies.

Success Stories: Shopify showcases success stories of merchants who have thrived using their platform, inspiring new entrepreneurs.

App Marketplace Revenue Sharing: Shares a portion of revenue generated by third-party apps with Shopify merchants, incentivizing app development for the platform.

Market Leader and Growth Potential

Market Share: Shopify is a dominant player in the e-commerce platform market, attracting a large user base and benefiting from network effects.

Constant Innovation: They continuously invest in research and development, introducing new features and expanding their offerings to stay ahead of the curve.

Global Presence: Shopify operates in a vast market with significant growth potential, particularly in developing economies.

Despite a 120% rally last year, the stock is still down by nearly 60% from its all-time high of $176 in 2021, while featuring an undeniably expensive valuation of 13 times sales and 70 times earnings. These figures are, however, well justified given its 20%+ YoY growth, and a 5-year CAGR of 40%. The company ended the quarter with $5 billion in cash, just $1.2 billion in debt, and $1.0 billion in cash flow. Our Target is $100 and we would not sell Shopify. We would suggest an over-allocation of this company in your portfolio. We believe in Shopify big time.

-----------------------------------------------------------------------------

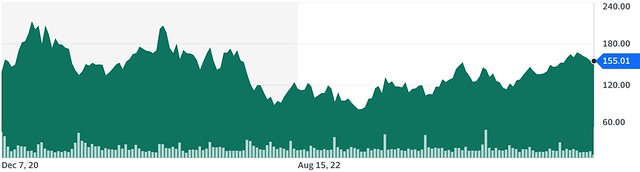

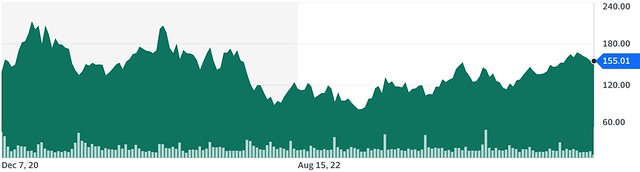

Airbnb (ABNB: $155, down 3%)

Long-Term Growth Portfolio

Vacation rental giant Airbnb ended the year on a high note, with its fourth-quarter results, reporting $2.2 billion in revenue, up 17% YoY, compared to $1.9 billion a year ago. The company posted a loss of $350 million, or $0.55 per share, against a profit of $320 million, or $0.48, with a miss on earnings, but a beat on top-line consensus estimates, with strong guidance bringing respite for investors. The loss during the quarter was the result of a $620 million tax settlement with the Italian government, which amounts to 41% of its net profits for the full year. This, of course, is a one-time expense, and the company will return to profitability in the coming quarters. Other operating metrics and Key Performance Indicators were impressive, to say the least, hinting at a rebound in global and domestic travel.

Gross booking values hit a fresh high of $15.5 billion in the quarter, up 15% YoY, and a mammoth 80% since 2019, driven by a total of 100 million nights booked on the platform, up 12% YoY. With its new initiatives aimed at helping hosts unlock more value, the platform added a record 1.1 million new listings during the past year, up 18% YoY, bringing its total active listings to 7.7 million located around the world.

Airbnb was been faced with a few challenges and headwinds in recent years, starting with regulatory scrutiny, the ban in New York City, and intensifying competition. It is, however, working hard and succeeding in differentiating itself, much of which involves its new focus on creating experiences, not just renting rooms. This, coupled with its new AI-assisted booking tools gives the company an upper hand against competitors.

Going forward, the company will be unlocking value across its massive landed base of hosts and guests. As of now, it is in a sound financial position, with $10 billion in cash reserves, $2.3 billion in debt, and $3.9 billion in cash flow. In light of this, the company announced a fresh $6 billion stock buyback program, adding further support to its 15% rally YTD. Our Target is $195 and our SP is $125. This company has been changing the world as we know it, and we are here to say that it will continue to change the world of travel and experiences. At $100 billion in market cap, this is no small company. We expect it to hit new all-time highs ($214) in 2025 or 2026. Many very intelligent minds on Wall Street have large positions in the stock. You should too.

-----------------------------------------------------------------------------

Netflix (NFLX: $555, down 11%)

Long-Term Growth Portfolio

Streaming giant Netflix released its first quarter results last week, reporting $9.4 billion in revenue, up 15% YoY, compared to $8.2 billion a year ago. The company posted a profit of $2.3 billion, or $5.28 per share, against $1.3 billion, or $2.88, while blowing past estimates on the top and bottom lines. The stock ran into a bad day on Wall Street Friday and fell with big boys – Microsoft, Google, Facebook, Nvidia, Super Micro Computers, and others. But let’s put this in perspective. The stock was at $328 a year ago. It was at $555, its current price, two months ago in February. So a little pullback doesn’t faze us in the slightest. The numbers that the company produced are really all that matters. Take a look, below, at the new subscribers the company added in the quarter.

The company did remarkably well across a host of other metrics, starting with net new subscribers at an amazing 9.3 million, up from just 1.8 million a year ago, driven by its crackdown on password sharing and other initiatives. Total memberships on the platform closed in on 270 million, up 16% YoY, and well ahead of Street estimates at 264 million. Netflix, however, believes that subscriber growth is no longer its primary focus as it was all this while, with revenue, margins, engagement, and customer satisfaction taking its place. The company plans to phase out the reporting of its quarterly membership figures, a plan that hasn’t gone over well with investors, but this pullback was an overreaction nonetheless. The move to stop sharing membership figures each quarter was done with the same in mind. We are disappointed about this decision, but we’ll have to live with it. We’ll just have to watch revenues and profits even more closely, which is really what it’s all about anyway.

Netflix’s next stage of growth will come from monetizing its massive landed base and network effects, and the launch of its ad-supported pricing tier. Its foray into live sports streaming and video games was done in pursuit of the same. Other avenues include theatrical releases of select content to recoup its investment, merchandising, and product placements which have remained underutilized.

Despite the pullback last week, the stock remains up 18% YTD and 70% over the past year, while trading at a valuation of under 8 times sales and 32 times earnings. During the quarter, the company repaid $400 million in debt, while repurchasing stock worth $2 billion, made possible by its increasingly robust balance sheet position with $7 billion in cash, $17 billion in debt, and $7.3 billion in cash flow. Our Target of $590 was hit after the stock ran up to $638 in early April. Have no fear – that number will be seen again in the coming months. We’re raising our Target to $650 and our Sell Price remains: we would not sell Netflix.

-----------------------------------------------------------------------------

Blackstone (BX: $118, down 4%)

Stocks For Success Portfolio

Private equity giant Blackstone released its first quarter results last week, reporting $2.6 billion in revenue, up 2.6% YoY, compared to $2.5 billion a year ago. The company posted a profit of $1.3 billion, or $0.98 per share, against $1.2 billion, or $0.97, with a marginal beat on earnings and a slight miss on the top line. Business as usual for the largest manager of assets in the world. Fee-related earnings during the quarter stood at $1.2 billion. Fresh inflows stood at $36 billion, down 36% from the prior quarter and 16% YoY, but impressive nonetheless, considering its size. Its uninvested capital has now reached $190 billion.

All of Blackstone’s core funds posted strong performances during the quarter, with its core and opportunistic real estate funds gaining 1.0%. This was followed by its corporate private equity and infrastructure funds, up by 3.4% and 4.8%, and finally, its credit and hedge funds appreciating by 4.1% and 4.6%, respectively, which are impressive figures. This performance has been driven by strong global equity markets, coupled with an end to the Fed’s hawkish stance, reigniting mergers and acquisition activities that had come to a standstill over the past 18 months. The central bank remains non-committal on further rate cuts, which should help the market move forward on the deal-making front going forward.

Why Blackstone is a Leader:

- Experienced Team: Blackstone has a team of seasoned professionals with deep expertise in various investment sectors. This expertise allows them to identify promising opportunities, manage risk, and generate strong returns for their clients.

- Strong Track Record: Their long history of success and consistent performance have earned them a reputation for excellence in the alternative investment industry.

- Scale and Resources: The sheer size of their AUM allows them to access exclusive deals, negotiate better terms, and attract top talent, further strengthening their position.

- Focus on Innovation: Blackstone actively explores new investment strategies and asset classes, staying ahead of the curve and adapting to evolving market trends.

- Client Focus: They prioritize understanding their clients' investment goals and risk tolerance, tailoring solutions that meet their specific needs.

Overall, Blackstone's combination of a diverse range of alternative investments, a highly experienced team, a stellar track record, immense resources, and a commitment to innovation makes it a dominant force in the alternative investment landscape.

The stock is down 8% YTD, following a 76% rally last year, but we cannot discount its potential for consistent fee income, from its $1.06 trillion in assets under management. Blackstone returned $1.2 billion to investors in buybacks, in addition to its annualized yield of 3.6%.

It’s been a good investment for us. We added the stock at $27 in 2016 and we have a Target of $150 on the stock. We would not sell Blackstone. The firm has the best asset managers in the world and that allows stockholders to sit back and let them do their thing.

-----------------------------------------------------------------------------

Alphabet (GOOG: $156, down 2%)

Stocks For Success Portfolio

Reporting Earnings This Week!

While revenues and profits continue to scale unabated, Google parent Alphabet has had an undeniably rough couple of months. On the heels of its first quarter results this week, some investors remain ill at ease, with the company firmly on the backfoot on the AI front, trailing behind competitors such as Microsoft, which is making massive strides in collaboration with OpenAI across its suite of products and services. Note that we at The Bull Market Report are not some of those investors who are ill at ease with this great company.

Google has introduced the world to Gemini, its generative Artificial Intelligence entry into the competition for the world’s eyeballs. Have you tried it yet? Powerful beyond words. Plus, the company still has remarkable moats, with integrations across platforms, browsers, and devices. Whether it is ChatGPT itself, or Microsoft’s Bing search engine with the new AI tool, Copilot, neither can build the kind of ecosystem that Google has painstakingly acquired over the years. Stay tuned for a NewsFlash on Alphabet after earnings are released on Thursday after the close.

-----------------------------------------------------------------------------

Microsoft (MSFT: $399, down 5%)

Stocks For Success Portfolio

Reporting Earnings This Week!

Tech giant Microsoft is doing everything right of late, and its market cap of $3 trillion at 30 times earnings reflects the same. Certain analysts and observers are concerned that this AI-driven exuberance is set to burst, but this is remarkable shortsightedness that comes from traditional valuation models which fail to factor in the remarkable disruptive and value creation potential of the latest advances in AI.

Just last week, the company released a research paper on AutoDev, its new framework for automated AI-driven coding. This framework will make manual coding a thing of the past, and bring application development to individual managers, as opposed to large teams. Software development jobs in the future will be more management and supervising of AI, rather than coding and development.

The company is set to release its third-quarter results after the close on Thursday, and more than its earnings and beat on consensus figures, we are looking forward to its next big exploits on the AI front. Microsoft made groundbreaking advances in AI in 2023, and we expect this momentum to continue unabated this year, as it unveils its growing prowess in this field across its massive portfolio of products and services. Stay tuned for a NewsFlash on Microsoft later this week after earnings are released.

-----------------------------------------------------------------------------

The Bull Market High Yield Investor

Concerns about persistently high inflation locking the Fed into high interest rates have rattled the bond market in particular but stocks are also feeling the pressure, seemingly confirming the common belief that once rates cross a certain threshold the environment gets toxic fast. But here's the reality: Going back across the past four decades, whenever 10-year Treasury yields spiked above 6%, the S&P 500 delivered an average annual return of 14.5%, compared to a less exuberant 7.7% return in years when bonds were paying less than 4%.

As it turns out, stocks performed better during periods of rising interest rates, with an average annual rolling one-year return of 13.9% as opposed to 6.5% in a falling rate environment. That probably isn't our world right now, but it supports the way the market has resisted its most bearish impulses as the economy adjusts to the Fed's most aggressive moves.

Remember, lower rates can often signal sluggish economic growth. The Fed cuts in the face of looming disaster and stays there until they’re 100% sure we’ve averted disaster. As a result, higher rates may actually reflect a stronger economy and the prospect of better corporate earnings, factors that usually bode well for the stock market. What's going on now?

Bond yields have been climbing since April, with the 10-year Treasury yield peaking near its highest level since November. This coincided with a decline in the S&P 500.

However, in our view, this anticipates a “return to normalization” with yields eventually settling around their 75-year average of 5%. You read that right. Rather than being some toxic frontier, 5% is average. It’s normal. And it’s really just about 2 percentage points above ambient inflation. If the Fed coaxes price pressure back down to its target, that translates to bond yields staying at or above 4%.

But the most important thing here is that the world didn't end in November, which is the last time long-term rates got this high. Unless something fundamental has broken in the last 5-6 months, the world is unlikely to end now. What matters to us is where the bond market starts paying a high enough yield to become a compelling alternative to dividend-paying stocks. Right now, we aren't especially impressed with anything less than 2 percentage points above ambient inflation, which eliminates just about the entire Treasury market from serious consideration.

Yields need to get higher to give stocks or even cash a run for their money. That means the bond market is in for more pain. And in that scenario, the risk-return calculations favor our High Yield recommendations as a place to park money and earn income at relatively low risk. They might not have the same near-zero risk profile as federal debt, but they make up for it by offering investors a chance to collect additional upside over time. Bond returns are fixed if you hold them to maturity. Stocks are always a work in progress, where we sacrifice certainty (nothing is "fixed") in exchange for a potentially richer long-term return.

However, our ability to say that with any degree of confidence requires some sense that dividends will keep coming. Congressional bickering aside, there's no threat that Treasury bonds will fail to pay the rate you lock in when you buy them. But if you can't count on your stocks to at least keep their dividends where they are, there's no clarity there at all. You want to know that your portfolio can pay the bills. If something starts to look like it isn't working, it needs to go. That's where we are now with one of our holdings.

BlackRock Income Trust (BKT: $11.37, up 1%. Yield=9.3%)

REMOVING FROM ACTIVE COVERAGE

A leading closed-end fund with exposures to mortgage-backed securities as well as US government treasuries, BlackRock Income Trust had been on an ascendant streak since the latter half of last year, but this momentum has since fizzled out. Yet, none of this should matter to conservative, income-seeking investors, with a long enough time horizon, given the fund’s remarkable yields.

The trust’s rally starting mid-last year was largely the result of the Fed ending its hawkish stance, and embarking on rate cuts for the first time in two years. Things, however, have changed in recent weeks, with the Federal Reserve now seemingly in no hurry to cut rates any further, resulting in a pullback in the stock, and leaving it down by 8% YTD.

The Trust invests in AAA-rated securities, backed by government agencies such as Fannie Mae and Freddie Mac. As interest rates rise, bond prices go down, and the stock trades at a discount to book value – currently 11%.

The trust is struggling to cover its distributions as of now, and analysts fear that a dividend cut is around the corner. This has put pressure on the stock and will put more pressure on the stock.

The stock has been a laggard for quite some time now. In the last 12 months, the stock is down 8% and there is some conjecture that the firm may have to cut its dividend. If that happens we can see the stock drop another 8% in the following month. We don’t want to take this risk so we would suggest a sale of the stock at this point. We are thus removing the stock from coverage. The investment hasn’t been a good one for us. We added the stock at $18.33 in 2019, and we should have gotten out a long time ago.

Good Investing,

Todd Shaver, Founder and CEO

The Bull Market Report

Since 1998

by Todd Shaver | Dec 30, 2019 | Free Newsletter (Sent Weekly Monday at 12pm)

The Weekly Summary

As the year winds up, the only question left for 2019 to answer is how far back you need to go to get a stronger year. The market this year is close to what we saw in 1998, and we would settle for matching that ultra-bullish dot-com boom. Beyond that, it only takes a few extra percentage points of victory lap before we need to pull out 1975 and even 1958 to find a comparable rally on the books.

Of course BMR stocks are up 41% so far this year, so we're rolling in outperformance either way. A full four of our recommendations doubled, tripled or quadrupled in 2019 and a wide range of others (including mighty Apple itself) are in the 80-95% zone. Only six BMR stocks went down. We're confident that they'll come back strong in 2020.

But then 2020 is the real question Wall Street needs to answer. In our view, the new year will start a lot like the last one, with stocks moving strong to the upside. All we need is a little relief on trade or some sunshine in the coming 4Q19 earnings season to carry the bulls into the summer, at which point the political landscape will undoubtedly get too hot for many investors to handle. That's all right. As long as we stick to our game plan, the election shouldn't hurt us one way or the other . . . and in any event, it's nearly a year down the road, so there isn't a lot of sense in worrying about the results at this stage.

There’s always a bull market here at The Bull Market Report! Gary Jefferson is back with a powerful look at what 2020 is likely to bring us, while The Big Picture focuses on the way markets can swing from dread to exuberance. The rally we're enjoying now isn't any more "irrational" than normal. As such, The High Yield Investor discusses some avenues if you're looking to lock in a little added income before the old year ends. We suggest taking a fresh look at Office Properties Income Trust and Omega Healthcare Investors.

The rest of our paid subscription newsletter is devoted to a few of our biggest winners of 2019 like Anaplan and Alphabet, along with some BMR stocks that fell hard in recent months but are already rebounding fast: Okta, Alteryx and Twitter.

Remember, the last day you can buy or sell stocks this year is Tuesday. Wednesday will be a market holiday and then we start fresh in 2020 on Thursday. As usual, our News Flashes will be a little light this week . . . if there's nothing to say, we won't bore you with filler. Instead, we'll be working behind the scenes to get you ahead of the new year.

Key Market Indicators

-----------------------------------------------------------------------------

BMR Companies and Commentary

The Big Picture: Animal Spirits In Control

Part of what won Yale economist Robert Shiller the Nobel Prize was his 2005 warning that the housing market was getting unsustainably overheated. Since then, people have come to him to tell the bulls they’ve gone too far. That’s why his recent admission that this record-breaking year on Wall Street is built on irrational factors is so illuminating. Shiller now sees “animal spirits” as the main factor driving what could easily become the best year since the 1950s.

He knows this isn’t logical. And he doesn’t mind. After all, the market isn’t always rational, but when something gets it moving away from the fundamentals, there’s no point in fighting the flow. You’ve simply got to know your own nature. If you aren’t confident enough to run with the bulls, stay on the sidelines and keep cashing 2% Treasury bond coupons. But there’s a lot of money to be made even in a frothy market. Once you let the bulls loose, they’ll run until they’re completely exhausted. Needless to say, we're excited. Even Bob Shiller seems relatively sanguine about how far this rally can continue in 2020 and beyond.

He’s far from alone. Sprawling trillion-dollar asset management complexes are sharing their 2020 outlooks now and they’re convinced bullish conditions will prevail for the foreseeable future. All we need is a mood strong enough to cut through the shocks. Wall Street isn’t climbing a wall of worry any more. We’re riding a wave of exuberance.

It really amounts to market physics. A stock in motion will remain in motion until an obstacle forces a course correction. At this point, there’s nothing big enough looming on the horizon to break the bulls’ stride. We’ve already lived through a year of trade war and earnings deterioration. That’s the status quo now, part of the background noise.

More importantly, it’s already built into the trailing year-over-year comparisons. We don’t need a big external stimulus like tax cuts or even the Fed to get the 2020 numbers going in the right direction. All we need is a little organic growth. That’s been building up behind the scenes as the Fed keeps interest rates low.

Builder confidence is at its highest level since 1999. New home sales are tracking at 2007 levels once again and there’s no ceiling in sight. This is just getting started. And even Bob Shiller, the housing bubble guy himself, has stopped fighting the mood. A year ago, he warned that the housing market reminded him of 2006, right before the crash. Conditions now look hotter than ever.

Shiller says it’s contagious. The impeachment hasn’t stopped it. The trade war hasn’t stopped it. Under normal circumstances, the bulls would have run out of breath by now. But while these aren’t normal circumstances, history shows that they aren’t absolutely unprecedented either. On Shiller’s scale, stocks are “quite high” now at a 30X inflation-adjusted earnings multiple.

Back in 1999, his metrics stretched a full 50% beyond where they are now. History didn’t end. This time around, they can go at least as far before they snap. After all, as Shiller says, we have a motivational speaker in the White House now, someone who loves to talk the market up when everyone else tries to talk it down. That's huge.

-----------------------------------------------------------------------------

Anaplan (PLAN: $53, down 1% last week )

While Anaplan was down a bit over the past week, it has doubled in the past year and BMR subscribers have captured a healthy 42% of that gain after we added it to the Aggressive portfolio back in March. The company still has significant upside since growth prospects for its decision making software remain bright.

At the forefront of “Connected Planning,” a category that it has created and is a part of the cloud computing category, the technology allows companies to make faster, and, it believes better decisions. Anaplan’s technology, which it calls Hyperblock, connects data through various company’s departments rather than centralizing decision making within the finance department. Currently aimed at large enterprises, there is still plenty of room for growth. At the start of 2019, the company had 1,100 customers and only 250 were part of the Global 2000.

Recent results demonstrate the company’s growth prospects. In the fiscal third quarter (ended October 31), Anaplan’s rapid top-line growth continues, with revenue increasing 44%, from $62 million to $89 million. Although the company has a history of expanding losses, management has slowed down the rate of expense growth. For the most recent period, Anaplan’s operating loss narrowed to $32 million compared to third-quarter 2018’s $50 million operating loss. Management boosted its fiscal 2020 guidance, including raising their revenue expectation to a 44% top-line increase ($347 million) versus their prior 42% expectation, up from $240 million in 2019.

BMR Take: With its pristine balance sheet ($50 million in debt and $310 million in cash), this major disrupter still offers exciting growth prospects as large companies continue to adopt its technology, which includes machine learning and other artificial intelligence. Our Target is $75 and our Sell Price is $45 and we would expect the stock to reach new all-time highs above $60 in the first part of 2020.

-----------------------------------------------------------------------------

Alphabet (GOOG: $1,352, flat)

The Search giant is up 30% for the year and is within 1% of an all-time record. Not bad for a company with a near-trillion-dollar market cap ($933 billion). The big news recently is that the founders have stepped back and turned over the running of the firm to Sundar Pichai. He’s been running the core Google business since 2015 but this latest promotion gives him a clear line of authority over the entire enterprise.

The search business is solid and obscenely profitable but is not growing terribly fast. Their cloud platform business however rose more than 80% last year, albeit still small at $4.4 billion in revenues. But give this two more years at this growth rate and you have a huge business generating big cash numbers. With revenue tracking near $160 billion in 2019, up from $137 billion in 2018 and $110 billion in 2017, there is nothing but more green ahead for the company.

They are also buying stock back like no tomorrow, with almost $6 billion being spent on shares in just the 3rd quarter. With $120 billion in cash on the books, and generating over $2 billion a month, this type of buying could continue for months if not years into the future. After all, nobody talks about the M-word on the Street, but you have to admit, with 88% of the search market, this company is a monopoly. Is there a risk of the governments of the world getting involved in Google’s business? Yes, of course.

But we think this is highly unlikely and if we didn’t already own stock in the company, we would be happy to acquire shares of this fabulous firm as soon as the market opens for trading on Monday morning. Trading at its all-time high, this concerns us not a bit. After all, why oh why do you think this company is trading at an all-time high? Because it is a cash machine, now and in the future. Our Target is $1450 and our Sell Price is: We would not sell Google.

-----------------------------------------------------------------------------

Twitter (TWTR: $32.50, up 1%)

What do you do when some of your favorites are down 20-50% from their highs? We go back to the basics.

We continue to love Twitter but the stock has been flat for months now, since October when it was trading in the low 40s. But many times the stock doesn’t tell the whole story. Revenues are good, not spectacular, growing from $2.4 billion in 2017 to $3.0 billion in 2018. This year looks like they will hit the $3.5 billion level, with profits of $1.60 per share in 2018 and what looks like $2.40 in 2019. Compared to a lot of other high-tech companies with virtually no earnings, it’s a nice breath of fresh air to see Twitter actually producing profits.

They still have a ton of cash at $5.8 billion, balancing $2.6 billion of debt. The exposure the company gets from our current president and from the world-changing events that it has been involved in (Arab Spring, Hong Kong) we expect good things from the company in the coming 5-10 years. We see the upside much greater than the downside risk. Our Target of $47 is Aggressive for this $25 billion company and our Sell Price of $25 will protect you on the downside.

-----------------------------------------------------------------------------

A Word From Gary Jefferson

Jefferson Financial Group

First Vice-President, Investments

UBS Financial Services, Inc.

After digesting dozens of 2020 forecasts from leading Wall Street firms and other outside resources, we want to give you our take on what WE see for the coming year.

First, we don't expect a bear market or a recession. The economy is doing great and it simply is not going to stop on a dime. The things that matter such as consumer confidence, consumer spending, wages, full employment, low interest rates and inflation are at some of the best levels we have seen in our lifetimes.

And the strong economy, of course, is what has and we believe is what will continue to energize the market in 2020. Just look at GDP. The final Q3 GDP estimate of 2.1% puts 2019's annual growth rate on pace to beat the average annual growth rate since this bull market began. Consumer Sentiment was up as well, rising to 99.3 from last month's 96.8.

Even though we key on earnings, if all one did was monitor the following four items, you could accurately forecast the strength of the economy with uncanny precision: GDP, employment, consumer sentiment and interest rates. All are really, really doing well.

Earnings are expected to slow down the first two quarters, but the positive impact from all of the prior rate cuts should hit bottom lines around the midpoint of next year. We anticipate positive growth in the first two quarters and up to 10% earnings growth across S&P 500 stocks for the full year. Thus, if there is going to be a sell-off or "correction," we expect it might be in January or February, triggered more by political consternation than lowered earnings estimates.

If we don't see a pullback early next year, we may have a period of volatility in the June area as politics heats up again with conventions and selections of final candidates. We expect these downswings, if they occur, will be headline-driven events and will therefore result in "buy-the-dip" opportunities for investors wanting to put extra cash to work.

What worked last year: Technology was the clear outperformer in 2019 while Energy was the largest underperformer. As we move in to 2020, we favor Communication Services and Consumer Discretionary stocks (including Amazon) and are not looking for much from either Technology or Energy. However, if Big Oil bounces back, it will come roaring back . . . in that scenario, we'll add to our coverage there.

Either way, as we view the entirety of the economy, tariffs, politics and the Fed, we believe all major sectors are capable of achieving low double-digit returns in 2020, while Consumer Staples, REITs, Utilities and Financials may still be capable of somewhat lower returns.

What we don't expect is smooth sailing throughout 2020. We expect plenty of volatility because of global trade tensions, Brexit and of course politics right here at home. We don't expect the Fed to raise or lower rates next year, but in case the economy needs a safety net, they will lower rates. Oil prices, of course, have always been a wild card, but we see plenty of supply to keep markets stable. We don't expect the president to be removed from office, but rather expect his pro-business policies (less government, fewer regulations and lower taxes) will continue to foster business growth and entrepreneurism.

As a comparison to what we expect, here is the case made by the Stock Trader's Almanac for 2020:

- Worst Case: Correction but no bear in 2020. Flat to single digit loss for full year due to on-going unresolved trade deals, no improvement in earnings and growth weakens further. Trump is removed from office by the Senate, resigns or does not run and political uncertainty spikes.

- Base Case: Average election year gains. Incumbent victory, trade and growth remain muddled, modest improvement in corporate earnings and Fed stays neutral to accommodative. 5-10% gains for DJIA, S&P 500 and NASDAQ.

- Best Case: Above average gains. Incumbent victory, trade resolved, growth improves, earnings improve and Fed stays neutral and accommodative. 7-12% for DJIA, 12-17% for S&P 500 and 17-25% for NASDAQ.

We lean toward the upside.

-----------------------------------------------------------------------------

The High Yield Investor

As we look toward 2020, most investors have flipped from indulging their grimmest recession fears to a posture closer to our own bullish bias. That's ultimately a good thing. However, it also sets up volatility ahead when expectations get too far ahead of reality, even for a brief period of time. We are looking for good things from the coming year. We just know that the route is going to be far from smooth.

Our top High Yield priority for the coming year is simple: hold defensive positions and wait for money to flow out of these stocks before you expand your holdings. You should have locked in a reasonable quarter-to-quarter income stream to cushion the downswings, so chasing these stocks while yields are relatively low doesn't make a whole lot of strategic sense. The goal is to lock in the highest yields possible, which means waiting until these stocks are out of favor.

It will happen. For now, as long as the rest of the market is rallying, there isn't a whole lot of urgency in building up your defense. And if you're feeling nervous, we suggest capturing the biggest yields you can to offset the impact of negative real interest rates around the world. Remember, the Fed won't raise interest rates again before annual inflation reaches 2%, so locking in anything less for the long term means you're locking in at least a little purchasing power deterioration . . . you are guaranteed to lose money at the end of the road. Who wants that?

Most of our recommendations pay well above 5% and some carry much higher yields as the market pivots from defense to enthusiasm. We'd like to discuss two of our favorites here. The first is ............ AND THIS IS WHERE YOU WILL GET THE BEST VALUE FROM BEING A PAID SUBSCRIBER. GO HERE TO SUBSCRIBE. YOU WILL BE HAPPY YOU DID: www.BullMarket.com/subscribe

Good Investing,

Todd Shaver, Founder and CEO

The Bull Market Report

Since 1998

by Scott Martin | Jul 1, 2019 | Free Newsletter (Sent Weekly Monday at 12pm)

Wall Street kept its fireworks in reserve last week ahead of a G-20 Summit that some predicted would either set the stage for a massive breakthrough on global trade or trigger a complete breakdown. We suspected that both extreme outcomes were unlikely when Chinese and U.S. diplomats are still so far apart on a negotiating framework much less the details that will make or break any proposed deal.

What we got was a continued truce in the trade war that will probably maintain the fragile status quo for months if not through the end of the year. That’s far from the worst scenario.

After all, the S&P 500 managed to rally 18% over the last six months, despite all the back-and-forth rhetorical escalation overseas and stalled earnings growth. We evidently aren’t alone in looking beyond the chatter to better days ahead, and with BMR stocks soaring 32% over the same period, it’s no wonder we’re optimistic.

However, success depends on your time horizon. While the last six months have been good for the market and our recommendations, this year-to-date rally needs to be weighed against an equally harrowing 4Q18 slide. Over the last 12 months, the S&P 500 is up only 8%. After that, while the market keeps tiptoeing from record to record, the gains have been grudging. Someone who bought the index in mid-September would be effectively back at zero now, nearly 10 months later.

BMR stocks, meanwhile, are up 40% end to end. Of course we weren’t in all of our current positions 12 months ago, so the raw number is a little misleading. We recommended 16 new companies over the past year and found compelling reasons to cut coverage on 7 others, keeping our portfolios fully exposed to the hottest areas of the market we can find. Some of those new stocks matured fast with 80-90% YTD performance. Others are taking a slightly slower route or are here to play a more defensive role, quietly accumulating dividends while flashier positions do their work.

All in all, however, our universe outperformed the index on the upside and held up a little better on the downside, both YTD and across the trailing year. BMR stocks held onto an 8% gain through the frustrating second half of 2018, then delivered nearly double what the market as a whole earned on the rebound. While nobody can say with certainty where we go from here, there’s no reason to assume that our track record will come to a sudden end now.

For one thing, BMR stocks collectively still have earnings growth on their side even though fundamentals for the S&P 500 now look stagnant (at best) through at least the release of 4Q19 numbers early next year. The trade war is only an intermittent threat where our recommendations are concerned.

And if the trade war becomes too big a drag on the global economy, the Federal Reserve has all but promised that it’s ready to cut interest rates. In that scenario, the tide of easier money helps all companies, and since ours aren’t under any pressure, the BMR universe stands to enjoy all of the benefits without accepting much of the trade war pain.

In the meantime, earnings season starts in a few weeks, so it’s time to start preparing for that cycle of corporate confessions. Expectations are low. A lot of investors have already discounted the entire earnings season and are looking toward the next Fed meeting at the end of July for a sign that it’s time to set off fireworks.

Remember, people who “sold in May and went away” last summer missed most of the year’s real gains, then buying back in when September rolled around only compounded their mistake. Summer can be a great time for investors, and at this point any significant progress on either earnings or trade will be enough to get stocks rallying in relief.

There’s always a bull market here at The Bull Market Report! The end of the quarter is the perfect time to review our strategic dividend focus in The Big Picture and then follow up with specifics in The High Yield Investor, which only subscribers got.

Key Market Measures (Friday’s Close)

-----------------------------------------------------------------------------

BMR Companies and Commentary

The Big Picture: Yield Is The Base

When stocks are soaring, our primary objective is to ensure that BMR subscribers are participating in the fun and not simply watching from the sidelines. And likewise, we urge you to buy the dips when a faltering market mood temporarily takes the stocks we recommend down with it.

Either way, we know the future will ultimately be better than the past. The only question is how fast we’ll get there in any particular swing of the market pendulum, given the bumps and detours that can make passive index fund investors so frustrated when the gains slow to a stall. The S&P 500 hasn’t even delivered 1% since mid-September while exposing shareholders to an extremely bumpy ride along the way.

Sometimes it isn’t worth the ride. In these consolidation periods when stocks have already burned through a lot of their rally fuel, the immediate returns have a hard time keeping up with the drain on investors’ nerves. That’s when we tend to spotlight our High Yield and REIT recommendations as an alternative to what could become months of empty angst.

Admittedly, these stocks and Closed End Funds aren’t risk free, but they pay back enough cash to buffer a lot of sluggish seasons. Right now someone could buy 10 shares of each of our 16 recommendations in these two portfolios for about $14,700. A year from now, the market may be willing to pay more or less to take those shares back from you, but along the way you’ll get 7% of that capital back in the form of dividends.

The question for you then boils down to where you think stocks will go in that year. Obviously our more aggressive, Technology-oriented posture has done a whole lot better than 7% over the past year, giving the active BMR universe a healthy 28% win in a period when the S&P 500 is only a little better than breakeven. But where will the next 12 months take us?

We’re optimistic that BMR stocks that led the world over the last year have what it takes to keep rallying as we look beyond 2019 into 2020. After all, 28% is a high enough score to justify a few rollercoaster lurches along the way. However, if the market as a whole suffers a sudden shock, the coming year could be a sour one for our universe as well as the S&P 500.

In that scenario, 7% looks pretty good. Depending on your situation, it could be enough to pay a few bills or provide the dry powder to buy temporarily depressed stocks on the dip. Either way, it’s a whole lot better than nothing, and it dramatically reduces the odds that you’ll need to liquidate at the bottom in order to raise cash.

And 7% isn’t even all that bad in absolute terms. Risk and returns go together. Treasury bonds are as risk-free as it gets, but the market won’t let you lock in more than 2% right now and that’s barely enough to keep up with inflation as it is. Stocks can soar or go over a cliff that takes them months or even years to climb back from, forcing investors to wait a long time before they get their money back.

The S&P 500 generally delivers somewhere between a 10% loss and a 20% gain across a typical 12-month period. Locking in a high dividend yield raises the floor and sacrifices a little absolute upside, smoothing the year-to-year return. In the past year, for example, our High Yield recommendations appreciated 3% beyond the dividends we got, translating into 10% performance for the group. Our REITs, on the other hand, are more about market performance, so we actually lagged the S&P 500 there over the past 12 months after factoring in dividend payments.

It happens. Next year these portfolio dynamics may reverse as the Fed pivots from tightening to a more relaxed policy and REITs go back on the offensive. As the market mood swings, we might see a prolonged stock slump crowd big money into both asset classes, adding significant appreciation to the 7% overall income base across the board. In a “flight to safety,” this is where nervous investors will come to hide. We won’t mind. We’re already here.

Either way, it’s all about diversification. We monitor every recommendation to ensure that they’re more likely to make their regular payments than their peers, but we also recognize that our view is always going to be imperfect. Sometimes one of our companies cuts its dividend after years of reliable performance and we need to evaluate whether it’s time to go. Because it happens so rarely, there’s safety in numbers . . . even if three of our sixteen yield choices cancel their distributions entirely, the aggregate performance floor for the group only drops from 7% to 5.5%.

We are confident that our dividend stocks will get through the next 12 months in better shape than that, in which case the real question turns back to whether you think you can do better than that income floor elsewhere. The S&P 500 may have what it takes. Year to date, the index is beating our REITs by 10% and is narrowly ahead of our High Yield portfolio as well. Our non-yielding growth stocks have rallied 40% in the last six months, so that’s an even better choice.

But if you think there’s even a chance that the coming year bodes badly for the market, it’s worth buying a little insurance that will enable you to squeeze at least some profit out of the seasons ahead. That’s what our yield portfolios are for. When our other stocks are making a lot of money, these quieter recommendations make a little money too. And when the market as a whole loses money, the dividends keep coming.

-----------------------------------------------------------------------------

Alphabet (GOOG: $1,081, down 4% -- all returns are for the week)

Continuing with our Stocks for Success coverage this week, Alphabet hasn’t been as successful as we’d like (up 3% YTD), but that includes the May dip, which the stock has yet to recover from. We were looking at a 22% YTD return prior to the selloff and continue to believe the stock is a prime buying opportunity as this is one of the most bankable long-term investments in the world.

Alphabet has a lot going for it beyond a monopoly on Search. The company is introducing a video game streaming service called Stadia, which could disrupt the entire gaming industry the way Netflix disrupted Hollywood. Stadia will allow users to play games without the need for a console. Additionally, Alphabet is already testing its Project Soli technology, which allows users to operate smart devices with mere hand gestures (no more tapping or swiping). This has immense implications for the smartphone, tablet and even the burgeoning smart-watch industries.

On the financial front, Alphabet has grown revenue at least 20% per year over the last three years, but in 1Q19 revenue growth came in at 17%. That, coupled with macroeconomic concerns is what tanked the stock. Of course, the market is being hyper-reactionary. 17% growth for a $750 billion company is astounding.

And the deceleration is a blip, not a trend. With YouTube dominating in mobile video streaming (37% market share – next biggest players are Facebook and Snapchat with just over 8%), autonomous vehicle manufacturer Waymo coming online soon, and the aforementioned Stadia and Project Soli set to disrupt major industries, there are simply too many revenue drivers for growth not to spike back up over that 20% mark. Additionally, Alphabet is trading at 5.5x price/sales, and its five-year average is 6.5x. So the stock is less expensive along that metric.

BMR Take: With $115 billion in cash and only $12 billion in debt, Alphabet can afford to get creative moving forward. Of course, management already has so many innovative technologies on the horizon, it might be best to just wait and see which ones live up to – or even exceed – expectations. This is a company that’s so cutting edge Hollywood made a movie about two guys trying to get a job there (The Internship.) Revenue growth will pick back up in no time, and so will the stock. We’re reiterating our $1,450 price target and our ‘would not sell’ position.

NOTE: In our weekly paid subscription Newsletter, we do between 5 and 7 SnapShots and also support regular Research Reports. The last three stocks we recommended are already up 5% apiece. Plus, we have the Weekly High Yield Investor, whereby we discuss the 17 stocks in our High Yield and REIT Portfolios.

And to top it all off, we send News Flashes each day during the week. Got a question about any stock on the market? We'll answer. So if your favorite stock reports earnings or there is significant news, you will hear about it here first. If you want the whole picture, join the thousands of Bull Market Report readers who are making money in the stock market and subscribe here:

www.BullMarket.com/subscription

It’s only $249 a year, and later this year we will be raising it to $499 or even $999 a year, it is just THAT valuable. But we will lock you in for life at this lower price.

Good Investing,

Todd Shaver, Founder and CEO

The Bull Market Report

Since 1998

Subscribe HERE:

www.BullMarket.com/subscription

Just $249 a year, soon to go up to $499. But you are guaranteed the SAME PRICE forever.