by Todd Shaver | Oct 30, 2023 | Instant News Flash

Leading manufacturer of continuous glucose monitoring systems, Dexcom (DXCM: $88), released its third quarter results last week, reporting $975 million in revenues, up 27% YoY, compared to $770 million a year ago. The company posted a profit of $200 million, or $0.50 per share, against $110 million, or $0.28, with the spectacular beat on consensus estimates for the coming quarter leading the stock to pop 10% to $89 following the results.

In addition, the company raised its guidance for the full year, now expecting revenues between $3.57 and $3.60 billion, with a YoY growth rate of 24%. These figures can largely be attributed to the rollout of its G7 device, which saw quick traction owing to the company’s solid base of over 18,000 physicians already writing scripts for its products, along with the brand it has painstakingly built over the years.

Another key catalyst for the company was realized in recent months with Medicare coverage for its continuous glucose monitoring devices going live for people with Type 2 diabetes using basal insulin only. It also includes certain non-insulin individuals with hypoglycemia, bringing its total potential customer base within the US alone to about 7 million people, with the figure only set to rise from here.

Dexcom saw similar dynamics play out across various international markets, particularly in France, where Dexcom One has secured reimbursement for all patients on intensive insulin therapy. In addition, the company witnessed a sizable uptick in sales from Japan, which was the first to establish broad reimbursement for diabetics late last year, representing over 1 million patients.

Dexcom is a medical technology company that develops and manufactures continuous glucose monitoring (CGM) systems. CGM systems provide people with diabetes with real-time information about their blood glucose levels, which can help them to better manage their diabetes. Dexcom's CGM systems are used by over a million people worldwide.

Dexcom is well-positioned for growth in 2024 and beyond. The company has a number of new products and ideas in the pipeline that could propel the stock higher. Here are a few examples:

- G7 CGM system: The G7 CGM system is Dexcom's next-generation CGM system. It is smaller, more accurate, and easier to use than Dexcom's previous CGM systems. The G7 CGM system is expected to be launched in the United States in early 2024.

- Dexcom ONE CGM system: The Dexcom ONE CGM system is a lower-cost CGM system that is designed to make CGM more accessible to people with diabetes. The Dexcom ONE CGM system is expected to be launched in the United States in mid-2024.

- Implantable CGM sensor: Dexcom is developing an implantable CGM sensor that would eliminate the need for people with diabetes to wear a patch on their skin. The implantable CGM sensor is expected to be launched in the United States in 2025.

- CGM integration with other devices: Dexcom is working to integrate its CGM systems with other devices, such as insulin pumps and smartwatches. This integration would allow people with diabetes to manage their diabetes more easily and effectively.

In addition to these new products and ideas, Dexcom is also benefiting from a number of other factors, including:

- Growing demand for CGM systems: The demand for CGM systems is growing rapidly as more and more people with diabetes recognize the benefits of CGM.

- Expanding reimbursement coverage: More and more insurance companies are reimbursing for CGM systems, which is making CGM more affordable for people with diabetes.

- International expansion: Dexcom is expanding its international presence, which is opening up new markets for the company's CGM systems.

The stock is down 21% YTD but has been on an ascendant streak over the past three weeks after hitting the 52-week low of $75 on October 12th. Another great piece of news for investors is the announcement of a $500 repurchase program, creating additional support for the stock while rewarding shareholders generously, made possible by over $3.2 billion in cash reserves. The company has $2.7 billion in debt and $750 million in cash flow. Our Target remains $120 with a Sell Price of $81. This is no small company, clocking in with a market cap of $34 billion.

by Todd Shaver | Oct 19, 2023 | Instant News Flash, Uncategorized

Streaming giant Netflix (NFLX: $403, up $57, up 16%) posted a remarkable third quarter performance last night, reporting $8.5 billion in revenues, up 7% YoY, compared to $7.9 billion a year ago. The company posted a profit of $1.7 billion, or $3.73 per share, against $1.4 billion, or $3.10, in addition to a beat on estimates at the top and bottom lines, resulting in a strong 14% post-market rally in the stock following the results.

During the quarter, the company posted strong metrics across the board, starting with its new paid subscribers at 9 million, bringing its total to 250 million. This is largely the result of its crackdown on account sharing, which is now in full swing. Netflix has further rolled out its $6.99 ad-supported pricing tier in select regions worldwide, where these plans now account for over 30% of new subscriber additions.

In addition to this, the platform’s engagement metrics so far this year are off the charts. According to Nielsen, Netflix hosted the most-watched original series for 37 of the 38 weeks this year, and the most-watched movie for 31 out of the 38. Its share of total TV screen time within the US now stands at 8%, far ahead of other competitors, and only lagging behind YouTube, which has taken a slight lead at 9%.

With the success of content such as One Piece, The Witcher, and Top Boy, Netflix has officially cracked the originals game and continues to give traditional Hollywood studios a run for their money. While licensed content will continue to play an outsized role, originals help unlock additional monetization opportunities such as theatrical releases, product placements, and merchandising.

Netflix expects a significant jump in its free cash flow at $6.5 billion, resulting in lower content expenses. In fact, they expect to spend $14 billion on content next year, down from $17 billion which will surely increase cash flow. This has prompted the company to increase its buyback authorizations by $10 billion, creating plenty of support for the stock. The company ended the quarter with $8.6 billion in cash, $17 billion in debt, and $4.6 billion in cash flow. The stock has been hit hard these past five weeks, for conceivably no good reason, as this quarter shattered expectations. This company remains one of our favorites. Our Target is $590 and our Sell Price is: We would never sell Netflix. Yes, the Target is high. But yes, the stock will get there. 2024? 2025? It WILL get there. The competition is shattered and will have to consolidate, with Netflix the clear winner.

by Todd Shaver | Sep 29, 2023 | Instant News Flash

The valuation of automaker Tesla (TSLA: $252) has long been an enigma for Wall Street and the company continues to astound and astonish analysts to this day. The stock was considered overvalued when it first went public in 2010, with a valuation of $2.2 billion, just as it is today with a market cap of $760 billion. And in the preceding years, many short-sellers have lost fortunes trying to bet against the company. We have a personal friend, a former Merrill Lynch VP who ran an office in Florida, who has been short for the last four years. He has lost over seven figures. We have implored him to buy back the stock, especially when it went to $102 in January of this year, down from the all-time high of close to $400 set in late 2021.

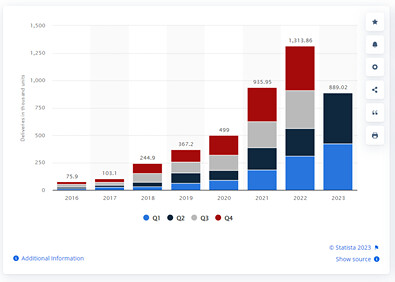

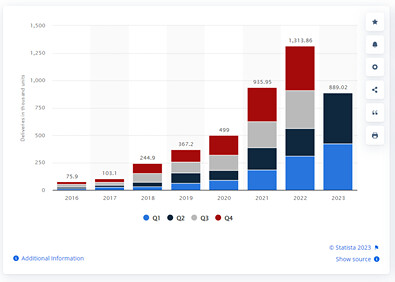

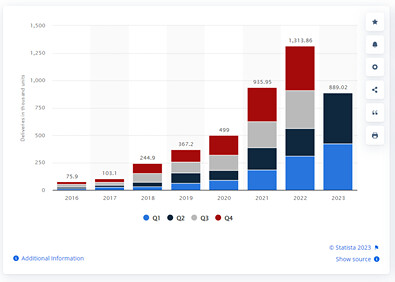

To be fair, it's hard not to question the exuberant valuations that the automaker has consistently held, which is 16 times the market cap of Ford Motors, a 120-year-old behemoth that sells twice as many cars as Tesla, and three times that of Toyota, which currently sells 10 times as many cars. Even considering Elon Musk’s ambitious goal of making 20 million cars a year by 2030, the valuations are a tough sell, particularly in the face of rising competition. The company is on track to deliver 2 million this year, up from 935,000 two years ago.

Number of Tesla vehicles delivered worldwide

Tesla has remained the most popular stock among retail investors for years. While it is also the most shorted stock as of now, with over $21 billion in short interest, the fate of these shorts looks increasingly shaky, similar to the many institutional, retail, and hedge fund bets made against the stock over the past decade. And as you know quite well by now since we have mentioned this numerous times, having a large short position is very bullish. Why? Because the only thing shorts can do is to BUY BACK their stock, which pushed the stock higher.

As discussed in our research report when we first began covering the stock two months ago, Tesla is not an automotive company, and it would be a mistake to value it as such. With its ambitious plans to flood the streets with robotaxis, its Dojo supercomputer that the Street estimates to be worth over $500 billion, the massive battery factory in Nevada, and innumerable other innovations, rather than an “automotive” company, this is a high-growth tech company through and through.

Reuters said this eight days ago: “Tesla has drawn up plans to make and sell battery storage systems in India and submitted a proposal to officials seeking incentives to build a factory, as Elon Musk continues a push to enter the country. Tesla has been in talks about setting up a new electric vehicle factory in India to build a [world] car priced around $24,000 for weeks, with discussions overseen directly by Prime Minister Narendra Modi.” We have heard that Tesla has plans for another large battery plant as well.

Another overlooked asset is the company’s extensive network of 45,000 superchargers, which it has yet to monetize. Most competitors have adopted Tesla’s North American Charging Standard. Rising competition and growing penetration of EVs on American roads only stand to benefit Tesla going forward.

Tesla is not just an automobile manufacturer; it is the future of mobility, computer vision, and sustainable technology, all rolled into one. Its vision-based AI system has applications beyond mobility, similar to its growing prowess in battery technology. With robust tailwinds across the board, and a well-capitalized balance sheet with $23 billion in cash, just $6 billion in debt, and $14 billion in cash flow, we believe that this company, with a market cap of $800 billion, run by an acknowledged genius, is poised to continue to change the world as we know it. Our Target is $325.

If you are still not convinced, get the new book called Elon Musk, by Walter Isaacson. We read all 615 pages in three days this week. He is changing the world that we live in.

by Todd Shaver | Aug 23, 2023 | Instant News Flash

Cisco (CSCO: $55), released its fourth quarter results last week, reporting $15.2 billion in revenues, up 16% YoY, compared to $13.1 billion a year earlier. The company posted a profit of $4.7 billion, or $1.14 per share, against $3.4 billion, or $0.83, beating consensus figures at the top and bottom lines for the umpteenth time, sending the stock higher following the results.

The company’s full-year figures were just as phenomenal with revenues at $57 billion, up 11% YoY, compared to $52 billion a year ago, with profits at $16 billion, or $3.89 per share, against $14 billion, or $3.36. The results were driven by strong momentum and substantial tailwinds arising from trends such as AI, cloud computing, and cybersecurity, all of which represent a dominant position for Cisco. Plus, the fact that Cisco is in a great business with no particular end in sight to its growth potential.

Cisco designs, manufactures and sells Internet Protocol (IP)-based networking and other products related to the communications and information technology (IT) industry. They are a leading provider of networking solutions for businesses of all sizes. Their products are used to connect people, devices, and applications together. Cisco has operations in over 160 countries with over 75,000 employees. Cisco is successful because they offer a wide range of high-quality products that meet the needs of businesses of all sizes. They also have a strong global presence and a commitment to innovation. Here are some of the businesses that Cisco dominates:

- Routers and Switches: Cisco is renowned for its routers and switches, which form the backbone of networking infrastructure. These devices enable data traffic management and efficient communication between devices within networks.

- Security Solutions: They offer a comprehensive suite of cybersecurity solutions, including firewalls, intrusion prevention systems, and secure access solutions, safeguarding networks from cyber threats and unauthorized access.

- Collaboration Tools: This includes video conferencing systems, collaboration software, and communication platforms like Webex, enabling remote teamwork, virtual meetings, and content sharing.

- Wireless and Mobility: The company provides wireless networking solutions, ensuring seamless connectivity for devices in both business and public environments.

- Data Center Infrastructure: Their data center offerings encompass servers, storage solutions, and networking equipment tailored for large-scale data processing, storage, and management.

- Cloud Services: Their cloud offerings include networking solutions for cloud data centers, ensuring efficient connectivity and management of cloud resources of this monstrous fast-growing business.

Cisco is in the process of transforming its business model, with a focus on growing the share of recurring revenues in its overall sales mix. The company expects modest year-over-year (YoY) growth rates in 2024, yet they remain proactive in developing cutting-edge innovations. In recent months they have unveiled a slew of new products, initiatives, and offerings. This includes the launch of its new scalable infrastructure to help customers process AI workloads more seamlessly, followed by XDR*, multi-cloud defense, and cloud-secure access which are seeing strong traction across the board, even onboarding marquee customers such as Goldman Sachs and Apple. Cisco has since received orders worth over $500 million for its new ethernet fabric for AI at scale. (From the recent Tech press: The Cisco CEO surprised analysts by mentioning it had already sold $500 million of AI gear. Cisco is wooing cloud companies away from offerings by Nvidia. One analyst says it's a promising start on a potentially huge new market.)

*XDR - Extended detection and response or XDR is a new approach to threat detection and response that protects against cyberattacks, unauthorized access, and misuse.

We believe Cisco to be a strong value at this level, trading at a little under 4 times sales, and 13 times earnings, which is enticing, and this is after a 20% rally starting in May. Cisco continues to reward shareholders generously, with $2.8 billion paid out in the form of dividends and buybacks during the fourth quarter, made possible by its $26 billion in cash, just $8.4 billion in debt, and $20 billion in cash flow. Our Target is $60 and our Sell Price of $41 is too low, so we are raising it today to $48.

As we said when we issued our Research Report on June 1st, “We can see the day when Cisco hits triple digits.”

by Todd Shaver | Aug 4, 2023 | Instant News Flash

This Is Where The Growth Is

Amazon had a blowout second quarter, with a beat on both ends, and an upbeat guidance for the third quarter sending the stock soaring by over 10% following the results, adding $14 billion in equity to stockholders. The company posted $134 billion in revenues, up 11% YoY, compared to $120 billion a year ago, with a profit of $6.7 billion, or $0.65 per share, a phenomenal improvement over a loss of $2 billion. Is this company big, or what! $134 billion in revenue for the quarter is quite amazing. The last four years of revenue look like this: $280 billion, $385 billion, $470 billion, and $515 billion last year. We can see them doing $600 billion in revenue for this year.

The company’s AWS cloud computing business posted $22 billion in revenues, up 12% YoY, which marks a slight deceleration but is remarkable nonetheless, considering the broad-based slowdown in enterprise IT spending. This segment has helped Amazon stay profitable and hold its head above water for years and still continues to do so, contributing over 70% to the company’s overall operating profits.

Despite substantial headwinds, the AWS segment leads in terms of sales growth and profitability, owing to steady demand for cloud computing infrastructure for generative AI and Machine Learning applications. In addition to this, the company’s advertising business continues to grow by leaps and bounds, hitting $11 billion in revenues, up 22% YoY, ahead of Alphabet and Meta at 3% and 12% growth, respectively.

Its core e-commerce business produced sales of $60 billion, up from $57 billion a year ago. Aided by its Prime Day event during the quarter, which saw a record 375 million items being delivered to customers at its quickest-ever delivery speeds, the segment posted an operating profit of $3.2 billion, emerging from a loss of $630 million during the year-ago period.

Following a 64% YTD rally, the stock still trades at a reasonable 2.5 times sales, offering plenty of value for investors. As it remains focused on unlocking value across its massive landed base, we expect its margins and profitability to consistently improve going forward, opening up avenues for dividends and buybacks. The company ended the quarter with $64 billion in cash, $180 billion in debt, and $54 billion in cash flow. Our Target is $205, the highest on the Street. We’re over 10% closer to that today. Our Sell Price is: We Would Not Sell Amazon.

by Todd Shaver | Feb 5, 2023 | Instant News Flash

Don't Believe The "Uninspiring" Part

Retail giant Amazon ($103) suffered after reporting its fourth quarter results last week even though $150 billion in revenues came in up 9% YoY compared to $137 billion a year ago. Even so, the company only posted a profit of $300 million or $0.03 per share, a sharp decline from the $14.3 billion or $1.39 per share it posted a year ago. This was a mixed quarter, with a beat on the top line, and a huge miss on consensus estimates at the bottom.

The company’s slowest ever quarterly growth in its 25-year history, coupled with a weak guidance for the upcoming quarters led the stock down by over 8%. Amazon was faced with a broad range of headwinds during the quarter, taking a $5 billion hit to the top-line from unfavorable foreign exchange rates, followed by supply-side issues owing to persistent lockdowns in China that have since come to an end.

Amazon’s full year figures were interpreted as equally "uninspiring," with revenues at $514 billion, up 9% YoY, and a loss of $2.7 billion, or $0.27 per share, against a profit of $33 billion, or $3.24 per share during the same period last year. This was mostly the result of a $12.7 billion valuation loss from its stake in Rivian Automotive during the year, along with the excess capacity the Online Commerce side of the company acquired during the pandemic and is now winding down.

During the quarter, Amazon Web Services once again led the way when it comes to sales growth and profit contribution. Revenues from the segment stood at $21.4 billion, up 20% YoY, with a profit of $5.3 billion, flat from the year before. This, however, marked a substantial deceleration from previous years, and came in below analyst estimates of 28% YoY growth.

AWS growth has been slowing down since 2015, in the face of saturation and rising competition, but things fared worse than expected during the quarter, as most enterprises across the world have started to cut back on cloud and tech spending in the face of broader uncertainties. This trend is expected to continue this new year, as the global economy sits firmly on the precipice of a recession.

Amazon had a few bright spots in its quarterly results that still anchor its broader, long-term growth story. This mainly pertains to its burgeoning advertising business which posted 19% growth YoY, while Google’s and Meta’s platforms struggle with a slowdown. This relatively new service already makes up 7% of the global digital advertising market, with a long multibillion-dollar runway ahead.

The stock has witnessed a pullback of almost 50% since its peak of $185 in November 2021, and trades at a perfectly reasonable two times sales. The company is yet to deliver value in the form of repurchases or dividends, but this will change as the economy continues to grow and its high margin services business continues to flourish. With nearly $60 billion in cash, $165 billion in debt, and $40 billion in cash flow, this company is a force to reckon with.

Our Target is $205 and we would never sell the stock. Amazon has continued to deliver exceptional value to consumers across many fronts, with its Prime streaming service continuing to gain traction, plus new partnerships commenced with HBO and Discovery during the quarter. Yes, the company had a rough time last year, but the company is a leader in retail and groceries, as well as the Cloud, and they continue to launch newer, high margin businesses such as healthcare, financial services, and supply-chain management, among others. Management will do everything in its power to remain at the top of its game and thrive in the future of world commerce. We believe in this company.